The missing relationship with Money

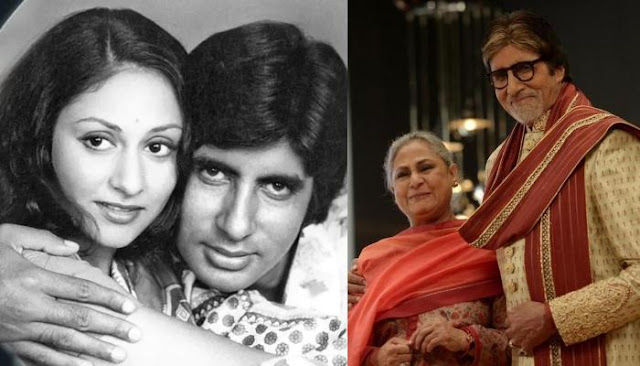

I just told my wife (pretty randomly) that Big B Amitabh Bachchan turns 80 this year (in a matter of a week) and next year, he will be celebrating the golden jubilee of his marriage anniversary with Jaya Bachchan.

Intently looking at her face for a reaction, I could almost sense the calculator wheels turning in her head :) We celebrated our 12th anniversary this year and she celebrated her 40th just last month.

The question of our age and health has come up in various contexts off late. Whether it is the general health conversation or children's marriage (and our age at that time), or the working-life remaining ahead and earning based on that, about retirement life and its challenges - physical as well as financial, about investments and how I have been late to it. Or simply how I need to lose weight (well, I must admit, that's the most common of all)

We have tossed around these things in conversation but in my head, I have been thinking about them pretty seriously. It's the last few years when I have been actively thinking about money - earning, saving, investing, growing etc - all of it. Before 2020, I did not really spend time thinking about money. Had a job, Got a salary - that's all there was to it. I wasn't thinking about planning my savings or investing or how to utilize the money. Now, it's a complex maze of earning enough to save and invest and investing enough to beat inflation and have a retirement fund, all the while cognizance of the escalating cost of living and educating kids. Conversations that I should have begun to have with myself long ago .. But then, better late than never.

Being Money Minded is not bad as long as you are planning positively rather than being obsessed about it. Money Management as a means to comfortably achieve life goals is crucial and should be a critical part of life planning. Money as Life Goal is just plain sad and does not really give you anything. You end up accumulating a lot of money but don't really know how to use it well or what kind of relationship to have with the money. High chances that you end up misusing or not using it appropriately or worse, losing most/all of it.

Over the last few months, I have also begun to understand the difference between a Financial Advisor and a Financial Coach - one working with you to enable your money to grow while the other working with you to improve your relationship with money. I am digging into the Financial Coaching subject further, because I believe it is important and something that should become very important for all. Also, being a Life Coach, I should be a equipped with the working knowledge of how Financial Coaching works. After all, my clients are definitely concerned about money and would need a bit of Financial Coaching too :) if not full fledged Financial Coaching, I should be able to give them an overview and point them in the right direction.

------------

And yes, after running through whatever chain of thoughts she was chasing; wifey just announced that we better activate our Swiss Trip plans that has been getting postponed since 2020 (which was suppposed to be a 10th anniversary trip for us). She is also saying that we better do the trip quick since (in her words) 'You are getting old" :(

#Age #health #finance #financialcoaching #lifecoaching #BigB #moneyminded #money #moneymanagement #earnings #savings #investment #lifegoals #coaching

Comments

Post a Comment